Zimbabwe telco to introduce digital KYC amid rising cyber fraud concerns

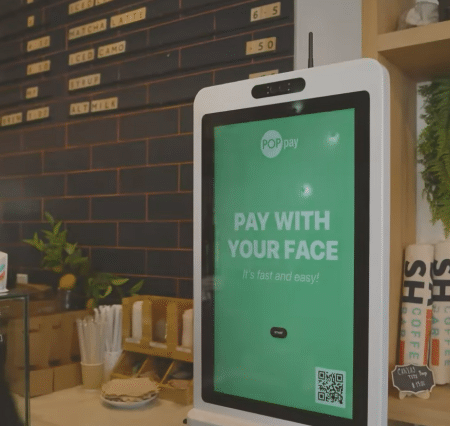

High levels of cyber fraud are pushing businesses in Africa, including telcos and those in the fintech space, to implement biometric systems for digital Know Your Customer (eKYC) processes. Rather than being an administrative burden, such rollouts could drive growth. Meanwhile compliance with AML and KYC requirements is also growing.

Econet to introduce face, voice and fingerprint biometrics

Zimbabwean telecoms firm Econet Wireless Zimbabwe Limited (Econet) is one of the latest to make biometrics and digital KYC a priority, reports New Zimbabwe.

In its recent report on the state of KYC in Africa in 2022, digital ID verification firm Smile Identity notes the importance of biometric KYC systems for African businesses, given the rising nature of financial fraud on the continent.

The report posits that biometric KYC checks are more efficient and effective in detecting ID fraud, noting that an average 50 percent of fraud incidents go unnoticed with textual KYC alone.

Cognizant of these realities, Econet Secretary Charles Banda is quoted by New Zimbabwe as saying the company plans to make face, voice and fingerprints biometrics part of its KYC system, especially as it looks forward to becoming a completely developed digital services provider.

According to Banda, modernizing their KYC system “will include biometric detection as well as digital identification, leading to better protection for our customers against growing cyber-security risks.”

The secretary noted that poor availability of foreign currency will remain a challenge for upgrades.

KYC compliance can fuel fintech growth

Meanwhile, an analysis by tech publication Ventures Africa argues that implementing digital KYC regulations is one of the ways in which fintechs in Africa can fuel exponential growth.

In the article, the writer paints a vivid picture of the situation of fintechs in Africa, how they are contributing to financial inclusion and economic development, the challenges they face in their day-to-day operations and what can be done to keep the business on a steady growth direction.

The article mentions that “innovations such as blockchain technologies and decentralized banking are playing a key role in driving the future of financial services.”

The think piece states that: “Economies with more mature financial systems and digital infrastructure, such as South Africa and Nigeria, are likely to see more innovation and advancements in financial services, including regulatory technology such as anti-money laundering (AML) and know-your-customer (KYC) compliance.”

Digital KYC, AML compliance rate could jump in 2023

With regard to digital KYC and AML compliance, an industry player has predicted a higher penetration rate this year as actors in the financial industry are becoming increasingly aware of the need for strict regulatory compliance.

The co-founder and CEO of digital ID and KYC solutions company VerifyMe Nigeria, Esigie Aguele, believes the penetration rate for compliance in Africa’s most populous country could rise to 70 percent in the course of 2023, reports Business Day.

“As financial crime evolves, regulators and financial institutions must improve their risk-based approach to AML issues and find new tools to detect risks and criminal links,” Aguele is quoted by the publication as saying.

“With regulatory progression, the industry will likely witness an increased focus on the use of technology to automate and streamline compliance processes.”

He holds that while AI and machine learning are vital players in enhancing KYC and AML screening, consumer analytics systems also have huge adoption prospects.

Several businesses in Nigeria, notably in the banking and insurance sectors, use VerifyMe’s infrastructure for customer onboarding and consumer analytics