Digital wallets and biometrics to replace traditional payments in UK: Mastercard survey

Roughly half (51 percent) of people in the UK believe physical wallets will become less relevant as digital ways to pay become increasingly popular, new research from Mastercard suggests.

The data hints at a decrease in cash usage in the UK. According to Mastercard, around 60 percent of payments were made in cash a decade ago, with UK Finance estimating that this figure will fall to 6 percent by 2031.

“In contrast to a decade ago, many who still carry wallets are now seeing them more as a site of personal archive rather than a vessel for physical cash and cards,” comments Kelly Devine, president of UK and Ireland at Mastercard.

“As technology continues to evolve, wallets shrink, and people increasingly embrace digital methods of payment, our focus remains on delivering choice, convenience, and speed for people around the country.”

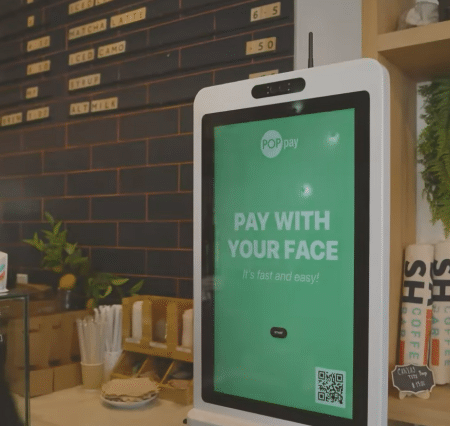

The research also highlights a corresponding increase in the adoption of digital payment methods globally, with 93 percent of consumers saying they will consider using alternative means of payment such as contactless, QR code, biometrics, and cryptocurrency transactions in the next year.

Scotland’s financial sector to lead UK biometrics efforts

Over a third of people living in Britain (36 percent) agreed that biometrics will be widely used for payments by 2025, according to a separate survey.

The figures come from a new report by Accenture, which was recently discussed by the company’s head of commercial banking for the UK and Ireland, Stuart Chalmers.

Writing in The Scotsman, Chalmers notes that 7 percent of the aforementioned 36 percent said they would be willing to use biometrics.

“We estimate that this will translate to £95 billion [$113.04 billion] of UK payments moving to biometrics in two years,” he writes.

At the same time, Chalmers warns that cost-of-living pressures and rising strains on household budgets are causing consumers to choose more traditional payment methods to help with budgeting as well as to reduce debt interest.

To tackle these negative factors and tap into new technologies such as the metaverse and phenomena like the ‘finfluencers,’ banks need to evolve further.

“As new payments trends, ways to engage customers and sustainability factors emerge, there is opportunity,” Chalmers explains.

“Digital technology is Scotland’s fastest-growing sector, and Scotland is the UK’s largest financial center outside of London, so the potential exists for Scottish-led organizations to drive further economic growth.”

The claims come a couple of months after the Scottish government unveiled plans to test its new digital identity platform early this year.